What will happen to the world economy in 2018? The global capitalist economy rises and falls in cycles, ie a slump in production, investment and employment comes along every 8-10 years. In my view, these cycles are fundamentally driven by changes in the rate of profit on the accumulated capital invested in the major advanced capitalist economies. The cycle of profitability is longer than the 8-10 year ‘business cycle’. There is an upwave in profitability that can last for about 16-18 years and this is followed by a downwave of a similar length. At least this is the case for the US capitalist economy – the length of the profitability cycle will vary from country to country.

Alongside this profitability cycle, there is a shorter cycle of about 4-6 years called the Kitchin cycle. And there also appears to be a longer cycle (commonly called the Kondratiev cycle) based on clusters of innovation and global commodity prices. This cycle can be as long as 54-72 years. The business cycle is affected by the direction of the profit cycle, the Kitchin cycle and and K-cycle and by specific national factors.

The drivers behind these different cycles are explained in my book, The Long Depression. There I argued that when the downwaves of all these cycles coincide, world capitalism experiences a deep depression that it finds difficult to get out of. In such a depression, it may require several slumps and even wars to end it. There have been three such depressions since capitalism became the dominant mode of production globally (1873-97; 1929-1946; and 2008 to now). The bottom of the current depression ought to be around 2018. That should be the time of yet another slump necessary in order to restore profitability globally. That has been my forecast or prediction etc for some time. Anwar Shaikh in his book, Capitalism, takes a similar view.

This time last year, in my forecast for 2017, I said that “2017 will not deliver faster growth, contrary to the expectations of the optimists. Indeed, by the second half of next year, we can probably expect a sharp downturn in the major economies …far from a new boom for capitalism, the risk of a new slump will increase in 2017.”

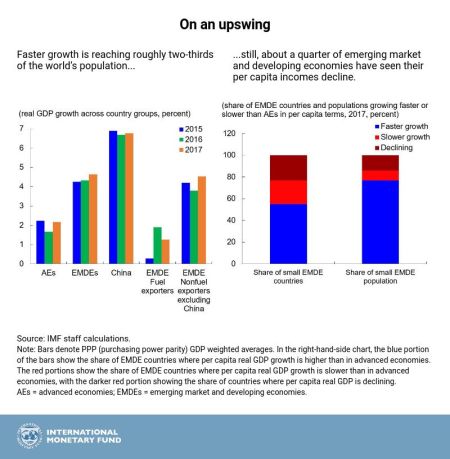

Well, as we come to the end of 2017 and go into 2018, that prediction about global growth proved to be wrong. Global real GDP growth picked up in 2017 – indeed, for the first time since the end of the Great Recession in 2009, virtually all the major economies increased their real GDP. The IMF in its last economic outlook put it like this: “2017 is ending on a high note, with GDP continuing to accelerate over much of the world in the broadest cyclical upswing since the start of the decade.”

The OECD’s economists also reckon that “The global economy is now growing at its fastest pace since 2010, with the upturn becoming increasingly synchronised across countries. This long-awaited lift to global growth, supported by policy stimulus, is being accompanied by solid employment gains, a moderate upturn in investment and a pick-up in trade growth.”

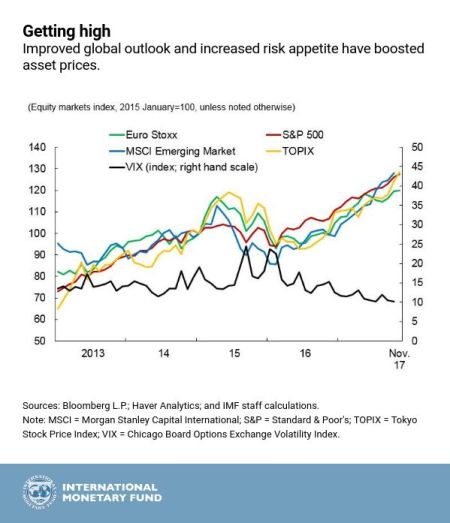

Alongside the (still modest) recovery in global growth, investment and employment in the major economies in 2017, financial asset markets have had a great year.

The IMF again: “Equity valuations have continued their ascent and are near record highs, as central banks have maintained accommodative monetary policy settings amid weak inflation. This is part of a broader trend across global financial markets, where low interest rates, an improved economic outlook, and increased risk appetite boosted asset prices and suppressed volatility.”

So all looks set great for the world economy in 2018, confounding my forecast of a slump.

But it is sometimes the case that when all looks rosy, a storm cloud can appear very quickly – as in 2007. First, it is worth remembering that, while world economic growth is accelerating a bit, the OECD reckons that “on a per capita basis, growth will fall short of pre-crisis norms in the majority of OECD and non-OECD economies.” So the world economy is still not yet out of the Long Depression that started in 2009.

Indeed, as the OECD economists put it: “Whilst the near-term cyclical improvement is welcome, it remains modest compared with the standards of past recoveries. Moreover, the prospects for continuing the global growth up-tick through 2019 and securing the foundations for higher potential output and more resilient and inclusive growth do not yet appear to be in place. The lingering effects of prolonged sub-par growth after the financial crisis are still present in investment, trade, productivity and wage developments. Some improvement is projected in 2018 and 2019, with firms making new investments to upgrade their capital stock, but this will not suffice to fully offset past shortfalls, and thus productivity gains will remain limited.”

The IMF’s economists make the same point. The latest IMF projection for world economic growth is for 3.7% global GDP growth over the 2017-18 period, an acceleration of 0.4 percentage points from the anaemic 3.3% pace of the past two years. But this is still less than the post-1965 trend of 3.8% growth and the expected gains over 2017-2018 follow an exceptionally weak recovery in the aftermath of the Great Recession.

The OECD also thinks that much of the recent pick-up is fictitious, being centred on financial assets and property. “Financial risks are also rising in advanced economies, with the extended period of low interest rates encouraging greater risk-taking and further increases in asset valuations, including in housing markets. Productive investments that would generate the wherewithal to repay the associated financial obligations (as well as make good on other commitments to citizens) appear insufficient.” Indeed, on average, investment spending in 2018-19 is projected to be around 15% below the level required to ensure the productive net capital stock rises at the same average annual pace as over 1990-2007.

The OECD concludes that, while global economic growth will be faster in the coming year, this will be the peak rate for growth. After that, world economic growth will fade and stay well below the pre-Great Recession average. That’s because global productivity growth (output per person employed) remains low and the growth in employment is set to peak.

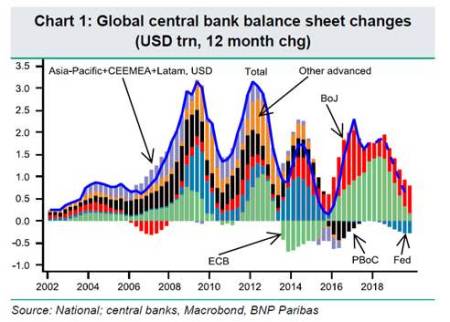

Former chief economist of Morgan Stanley, the American investment bank, Stephen Roach remains sceptical that the low growth environment since the end of the Great Recession is now over and the capitalist economy is set for fair winds. Such growth as the major economies have seen has been based on very low interest rates for borrowing and rising debt in the corporate and household sectors. “Real economies have been artificially propped up by these distorted asset prices, and glacial normalization will only prolong this dependency. Yet when central banks’ balance sheets finally start to shrink, asset-dependent economies will once again be in peril. And the risks are likely to be far more serious today than a decade ago, owing not only to the overhang of swollen central bank balance sheets, but also to the overvaluation of assets.”

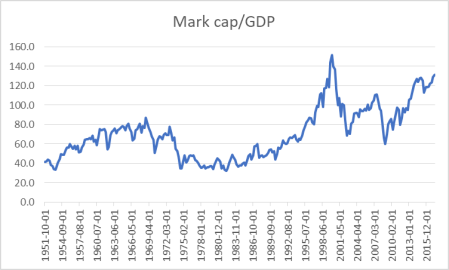

Stock markets are hugely ‘overvalued’, at least according to history. The cyclically adjusted price-earnings (CAPE) ratio of 31.3 is currently about 15% higher than it was in mid-2007, on the brink of the subprime crisis. In fact, the CAPE ratio has been higher than it is today only twice in its 135-plus year history – in 1929 and in 2000. “Those are not comforting precedents” (Roach). One measure of the price of financial assets compared to real assets is the stock market capitalisation compared to GDP (in the US). It has only been higher just before the dot.com bust of 2000.

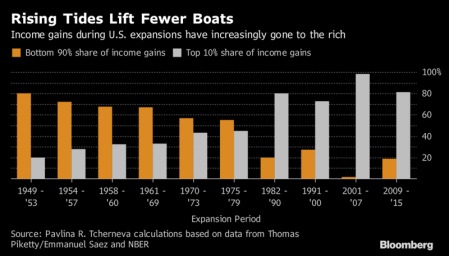

And I don’t need to tell readers of this blog that any economic recovery for world capitalism since 2009 has not been shared ‘fairly’. There has been a host of data to show that the bulk of increase in incomes and wealth has gone to top 1% of income and wealth holders, while real wages from work for the vast majority in the advanced capitalist economies have stagnated or even fallen.

The main reason for this growing inequality has been that the top 1% own nearly all the financial assets (stocks, bonds and property) and the price of these assets have rocketed. Corporations, particularly in the US, have used any rise in profits mainly to buy back their own shares (boosting their price) or pay out increased dividends to shareholders. And these are mainly the top 1%.

Companies in the S&P 500 Index bought $3.5 trillion of their own stock between 2010 and 2016, almost 50% more than in the previous expansion.

There are two things that put a question mark on the delivery of faster growth for most capitalist economies in 2018 and raise the possibility of the opposite. The first is profitability and profits – for me, the key indicators of the ‘health’ of the capitalist economy, based as it is on investing and producing for profit not need.

In this context, let’s start with the US economy, which is still the largest capitalist economy both in total value, investment and financial flows – and so is still the talisman for the world economy. As I showed in 2017, the overall profitability of US capital fell in 2016, making two successive years from a post-Great Recession in 2014. Indeed, profitability is still below the pre-crisis peaks (depending on how you measure it) of 1997 and 2006.

As far as I can tell, in 2017, profitability flattened out at best – and still well down from 2014.

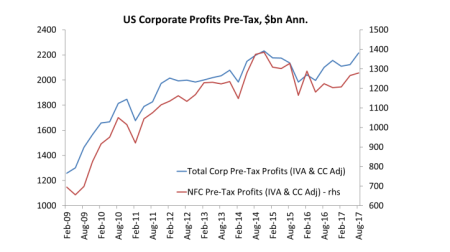

The total or mass of profits in the US corporate sector (that’s not profitability, which is measured as profits divided by the stock of capital invested) has recovered from the depths of the Great Recession in 2009. But the mass of profit slipped back sharply in 2015 (along with profitability, as we have seen above). This fall stopped in mid-2016. The fall seemed to coincide with the collapse in oil prices and the profits of the energy companies in particular. But the oil price stabilised in mid-2016 and so did profits (although profitability continued to fall). Profits rose again in 2017, but, after stripping out the mainly fictitious profits of the financial sector, the mass of profit is still well below the peak of end-2014 (red line below).

As I have shown in other places when profits fall back, so will investment within a year or so. On the basis of the data for the US, 2017 produced flat profitability and a very small recovery in profits. That suggests that, at best, investment in productive capacity will grow very little in 2018, especially as much of these profits are going into unproductive assets, property and financial.

What about the rest of the world? Well, it is clear that the European capitalist economies (with the exception of post-Brexit Britain) have recovered in 2017. Real GDP growth has picked up, led by Germany and northern Europe, although it is still below the growth rate in the US. Japan too has recorded a modest recovery.

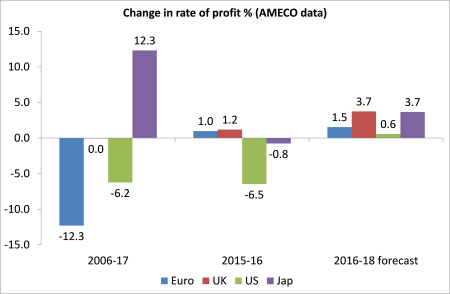

When we look at profitability, however, in core Europe it rose only slightly and fell in Japan in 2015 and 2016, as in the US. Indeed, only Japan has a higher rate of profit compared to 2006.

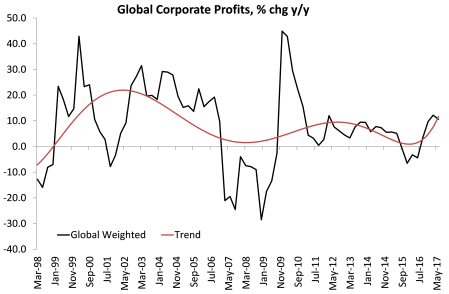

When we look at the mass of global corporate profits (using my own measure), there has been a modest recovery in 2017 after the fall in 2015-6. But remember my measure includes China, where profits in the state enterprises rose dramatically in 2016-7.

On balance, if profits and profitability are good indicators of what is to come in 2018, they suggest much the same as 2017 at best – but probably not provoking a slump in investment.

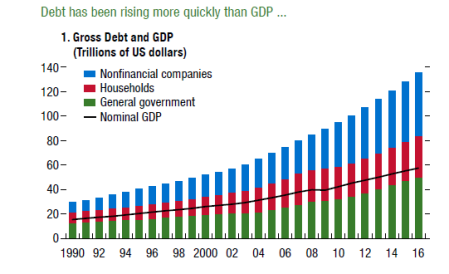

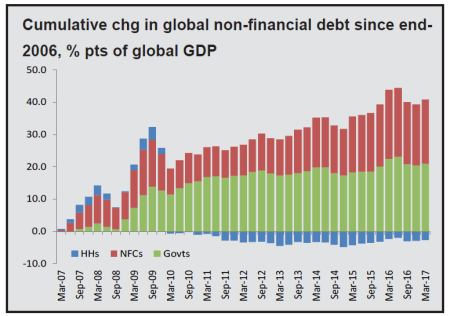

The other question mark against the overwhelming optimism that 2018 is going to be a great year for global capitalism is debt. As many agencies have recorded and I have shown in this blog during 2017, global debt, particularly private sector (corporate and household) debt has continued to rise to new records.

The IMF comments “Private sector debt service burdens have increased in several major economies as leverage has risen, despite declining borrowing costs. Debt servicing pressure could mount further if leverage continues to grow and could lead to greater credit risk in the financial system.”

Among G20 economies, total nonfinancial sector debt (borrowing by governments, nonfinancial companies, and households from both banks and bond markets) has risen to more than $135 trillion, or about 235% of aggregate GDP. In the G20 advanced economies, the debt-to-GDP ratio has grown steadily over the past decade and now amounts to more than 260% of GDP.

The IMF sums up the risk. “A continuing build-up in debt loads and overstretched asset valuations could have global economic repercussions. … a repricing of risks could lead to a rise in credit spreads and a fall in capital market and housing prices, derailing the economic recovery and undermining financial stability.”

The IMF economists do not see this risk of a new debt bust happening until 2020. They may be right. But the policy of low interest rates and huge injections of credit by the main central banks is now over. The US Federal Reserve is now hiking its policy interest rate and has stopped buying bonds. The European Central Bank will end its buying in this coming year; the Bank of England has already stopped. Only the Bank of Japan plans more bond purchases through 2018. The cost of borrowing is set to rise while the availability of credit will fall. If profitability continues to fall in 2018, this is a recipe for investment collapse, not expansion. This would especially hit the corporate sector of the so-called emerging economies.

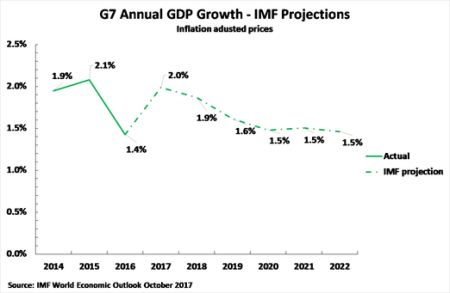

Even if the major capitalist economies avoid a slump in 2018, nothing else has much changed. Economic growth in the major economies remains low compared to before the Great Recession, even if it picks up in 2018. And the prospect for the medium term is poor indeed. Productivity (output per person working) growth is very low everywhere and employment growth from here will be muted. So the potential long-term growth rate of the major economies will slow from any peak achieved in 2018. After very low growth in 2016 of only 1.4%, the IMF predicts G7 growth in 2018 of 1.9% – a moderate but real upturn. However, G7 growth is then predicted to fall to 1.6% in 2019 and to a poor 1.5% in 2020-2022.

Thus the upturn in 2017-2018 seems cyclical and will not be consolidated into a new longer sustained ‘boom’. That’s because, if there is no slump to devalue capital (productive and fictitious) and thus revive profitability, then investment and productivity growth will stay stuck in depression. Overall growth in the G7 economies since the Great Recession has been slower than during the ‘Great Depression’ of the 1930s. Indeed, based on IMF projections, by 2022, that is 15 years after 2007, total GDP growth in the G7 economies will only be 20% compared to 62% in the 15 years after 1929. And that assumes no major economic slump in the next five years.

Nevertheless, despite weak profitability and high debt, the modest recovery in profits in 2017 suggests that the major capitalist economies will avoid a new slump in production and investment in 2018, confounding my prediction.

Now when you are proved wrong (even if only in timing), it is necessary to go back and reconsider your arguments and evidence and revise them as necessary. Now I don’t think I need to revise my fundamentals, based as they are on Marx’s laws of profitability as the underlying cause of crises. Profits in the major economies have risen in the last two years and so investment has improved accordingly (to Marx’s law). Only when profitability starts falling consistently and takes profits down with it, will investment also fall. Until that happens, the impact on the capitalist sector of the rising costs of servicing very high debt levels can be managed, for most.

What seems to have happened is that there has been a short-term cyclical recovery from mid-2016, after a near global recession from the end of 2014-mid 2016. If the trough of this Kitchin cycle was in mid-2016, the peak should be in 2018, with a swing down again after that. We shall see.

No hay comentarios:

Publicar un comentario