From China to Mars

September 5, 2016

The weekend meeting of the heads of state of the top 20 economies in the world (G20) in the Chinese resort of Hangzou concluded that the global economy was still in trouble. The IMF reckoned 2016 would be the fifth consecutive year in which global growth was below the 3.7% average recorded in the period from 1990 to 2007.

And just before the G20 summit, the IMF issued a report forecasting even slower growth than that rate. “High frequency data points to softer growth this year, especially in G-20 advanced economies, while the performance of emerging markets is more mixed”. It went on: “The global outlook remains subdued, with unfavorable longer-term growth dynamics and domestic income disparities adding to the challenges faced by policymakers. Recent developments—including very low inflation, along with slowing investment growth and trade—broadly confirm the modest pace of global activity. The decline in investment, exacerbated by private sector debt overhangs and financial sector balance sheet issues in many countries, low productivity growth trends, and demographic factors weigh on long-term growth prospects, further reducing incentives for investment despite record-low interest rates. A period of low growth that has bypassed many low-income earners has raised anxiety about globalization and worsened the political climate for reform. Downside risks still dominate.”

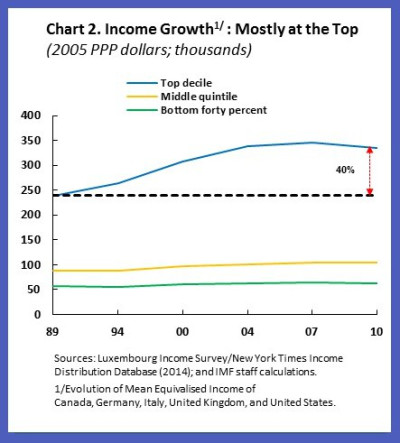

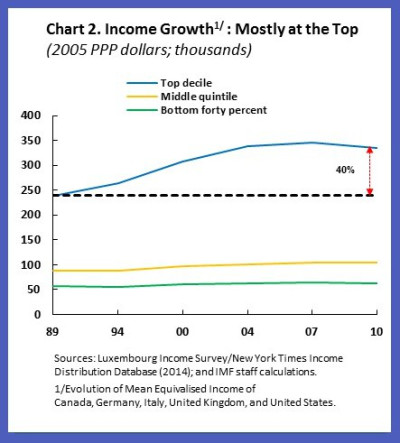

IMF chief, Christine Lagarde, also blogged that “Weak global growth that interacts with rising inequality is feeding a political climate in which reforms stall and countries resort to inward-looking policies. In a broad cross-section of advanced economies, incomes for the top 10 percent increased by about 40 percent in the past 20 years, while growing only very modestly at the bottom. Inequality has also increased in many emerging economies, although the impact on the poor has sometimes been offset by strong general income growth”.

Low growth, high debt, weak productivity and rising inequality: that’s the story of the world economy since the end of the Great Recession in 2009.

What did the IMF suggest to the G20 leaders as way out of this depressed activity? First, more “demand” support. But monetary policy (zero or negative interest rates and printing money) was not working. So it was“time to boost public investment and upgrade infrastructure”. But the world needs more neo-liberal type ‘structural reforms’, like deregulation of labour and product markets, reducing pension schemes etc, in order to boost profitability. But there should also be less inequality through higher basic benefits and increased education for low-wage earners. So we need more globalisation, world trade, neoliberal reforms and less inequality. Reconcile those!

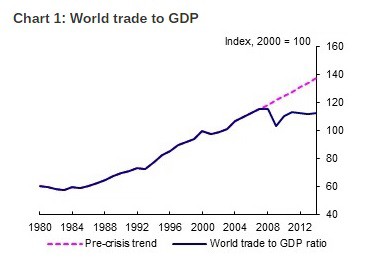

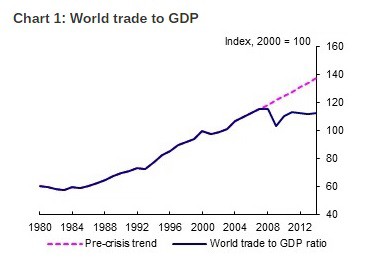

One idea that dominated the G20 meeting was the need to boost world trade and support ‘globalisation’. As this blog has reported often, world trade growth has been dismal and is a big feature of the Long Depression since 2009.

But worse for global capitalism, and American imperialism in particular, there has been a growing trend away from ‘globalisation’ (free trade of goods, services and capital flows for big business). The World Trade Organisation trade agreements have stopped and the regional mega-deals like TTP and TTIP are in serious jeopardy. Everywhere, governments are under pressure to block further deals and even reverse them (eg Trump on NAFTA). So Lagarde called for renewed support for globalisation and the neo-liberal era now under attack.

The Chinese were particularly worried because global trade growth is vital to its export, investment-led economic model. Chinese President Xi Jinping was vocal in a call for wider trade and investment. “We should turn the G20 group into an action team, instead of a talk shop,” he said.

Meanwhile, optimism that a proper world economic recovery remains. Gavyn Davies in the FT has recently been claiming that his Fulcrum forecasting agency was finding a world economic pick-up. However, this weekend, he was slightly less sanguine. “In August, we have received no confirmation that a cyclical upswing is gaining momentum. But nor has there been a significant decline in activity: the jury is still out”.

At the beginning of the year, many mainstream economists reckoned that China and other ‘emerging’ economies were going south and would drag the rest of the world down with them. I disagreed at the time. The optimism for recovery then switched to the US and even Europe.

However, as we move into the last part of 2016, it has become clear that the US economy has slowed down even more and Europe has achieved hardly any pick-up at all. So now the optimism has swung back to the major emerging economies. As the UK’s accountancy firm Deloitte economists put it today: “The downward trend for emerging market activity seems to have run its course. Growth is widely expected to accelerate in 2017. India is forecast to grow by 7.6% next year, the fastest rate of growth among any major economy. Brazil and Russia are likely to emerge from recession. Chinese growth is expected to ease, but, at a forecast 6.2% in 2017, would still be far higher than global averages. Crucially, the risk of a Chinese ‘hard landing’ has eased.”

So it’s back to the future with the so-called BRICs leading the way out of the depression. We’ll see.

Talking of back to the future, one of the biggest policy calls from mainstream economists has been for governments to launch more infrastructure spending (building roads, rail, bridges, power stations, telecoms etc) to get economies going. So far, this has been largely ignored by governments trying to cut budget deficits with reductions in government investment spending or facing high public debt levels.

The latest call on this front has come from the economists of the Australian investment outfit, Macquarie. Why not colonise Mars? “It is not as crazy as it sounds,” wrote Viktor Shvets and Chetan Seth from the Macquarie global equities team. “A giant Mars colonisation program would create a vast, capital-intensive industry which would span the globe, create jobs, and address the global economy’s productivity problem.”

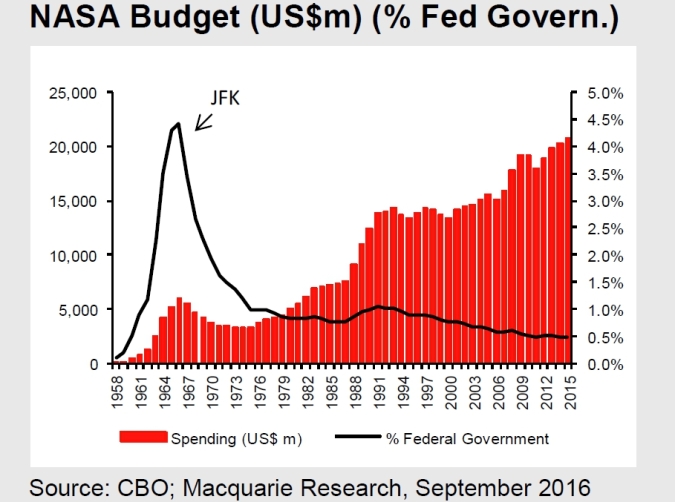

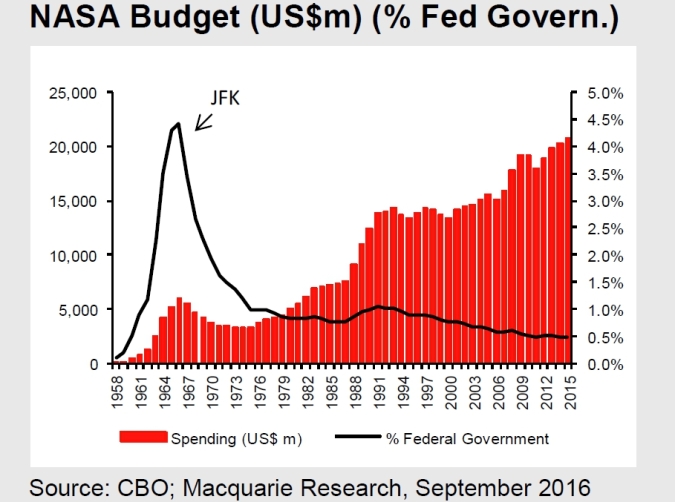

You see, the world economy is not growing at a sufficient rate because there are “declining returns on investment”. So what we need to do is to start a huge government programme to colonise Mars, similar to the space program of the 1960s under Kennedy that led to landing on the Moon.

Interestingly, the Macquarie economists are not interested in a global investment programme to help the poorest in the world to develop; to help solve the global environmental disaster or to boost education, health and basic infrastructure in the poorest countries on Earth. No, that is not as useful (profitable) as investing in another planet to get returns on investment up.

The Macquarie solution is the ultimate in Keynesian economic policy (short of ‘war Keynesianism’). It is the idea that there is plenty of capital available but just no ‘investment opportunities’ due to lack of demand. So war or space can offer a way out.

The Macquarie economists think that the huge injection of money and credit into financial assets, that has driven interest rates to zero or below is what has created low returns. But low returns on capital, generated by too much capital, is a neoclassical marginalist theory (that Keynes held to). It is confusing ‘fictitious’ capital with productive capital.

The Marxist view is different. Productive investment is not taking place because of ‘too much capital and low demand’ but because of too little surplus value or profitability from productive capital. And low profitability will not be improved by government spending on a space program. On the contrary. In the 1960s, the space program was affordable because of high (not low) profitability in the capitalist sector. So unproductive expenditure, which no doubt did develop new technology and employment for many, was affordable. That is the opposite now. There is no way out through Mars.

And just before the G20 summit, the IMF issued a report forecasting even slower growth than that rate. “High frequency data points to softer growth this year, especially in G-20 advanced economies, while the performance of emerging markets is more mixed”. It went on: “The global outlook remains subdued, with unfavorable longer-term growth dynamics and domestic income disparities adding to the challenges faced by policymakers. Recent developments—including very low inflation, along with slowing investment growth and trade—broadly confirm the modest pace of global activity. The decline in investment, exacerbated by private sector debt overhangs and financial sector balance sheet issues in many countries, low productivity growth trends, and demographic factors weigh on long-term growth prospects, further reducing incentives for investment despite record-low interest rates. A period of low growth that has bypassed many low-income earners has raised anxiety about globalization and worsened the political climate for reform. Downside risks still dominate.”

IMF chief, Christine Lagarde, also blogged that “Weak global growth that interacts with rising inequality is feeding a political climate in which reforms stall and countries resort to inward-looking policies. In a broad cross-section of advanced economies, incomes for the top 10 percent increased by about 40 percent in the past 20 years, while growing only very modestly at the bottom. Inequality has also increased in many emerging economies, although the impact on the poor has sometimes been offset by strong general income growth”.

Low growth, high debt, weak productivity and rising inequality: that’s the story of the world economy since the end of the Great Recession in 2009.

What did the IMF suggest to the G20 leaders as way out of this depressed activity? First, more “demand” support. But monetary policy (zero or negative interest rates and printing money) was not working. So it was“time to boost public investment and upgrade infrastructure”. But the world needs more neo-liberal type ‘structural reforms’, like deregulation of labour and product markets, reducing pension schemes etc, in order to boost profitability. But there should also be less inequality through higher basic benefits and increased education for low-wage earners. So we need more globalisation, world trade, neoliberal reforms and less inequality. Reconcile those!

One idea that dominated the G20 meeting was the need to boost world trade and support ‘globalisation’. As this blog has reported often, world trade growth has been dismal and is a big feature of the Long Depression since 2009.

But worse for global capitalism, and American imperialism in particular, there has been a growing trend away from ‘globalisation’ (free trade of goods, services and capital flows for big business). The World Trade Organisation trade agreements have stopped and the regional mega-deals like TTP and TTIP are in serious jeopardy. Everywhere, governments are under pressure to block further deals and even reverse them (eg Trump on NAFTA). So Lagarde called for renewed support for globalisation and the neo-liberal era now under attack.

The Chinese were particularly worried because global trade growth is vital to its export, investment-led economic model. Chinese President Xi Jinping was vocal in a call for wider trade and investment. “We should turn the G20 group into an action team, instead of a talk shop,” he said.

Meanwhile, optimism that a proper world economic recovery remains. Gavyn Davies in the FT has recently been claiming that his Fulcrum forecasting agency was finding a world economic pick-up. However, this weekend, he was slightly less sanguine. “In August, we have received no confirmation that a cyclical upswing is gaining momentum. But nor has there been a significant decline in activity: the jury is still out”.

At the beginning of the year, many mainstream economists reckoned that China and other ‘emerging’ economies were going south and would drag the rest of the world down with them. I disagreed at the time. The optimism for recovery then switched to the US and even Europe.

However, as we move into the last part of 2016, it has become clear that the US economy has slowed down even more and Europe has achieved hardly any pick-up at all. So now the optimism has swung back to the major emerging economies. As the UK’s accountancy firm Deloitte economists put it today: “The downward trend for emerging market activity seems to have run its course. Growth is widely expected to accelerate in 2017. India is forecast to grow by 7.6% next year, the fastest rate of growth among any major economy. Brazil and Russia are likely to emerge from recession. Chinese growth is expected to ease, but, at a forecast 6.2% in 2017, would still be far higher than global averages. Crucially, the risk of a Chinese ‘hard landing’ has eased.”

So it’s back to the future with the so-called BRICs leading the way out of the depression. We’ll see.

Talking of back to the future, one of the biggest policy calls from mainstream economists has been for governments to launch more infrastructure spending (building roads, rail, bridges, power stations, telecoms etc) to get economies going. So far, this has been largely ignored by governments trying to cut budget deficits with reductions in government investment spending or facing high public debt levels.

The latest call on this front has come from the economists of the Australian investment outfit, Macquarie. Why not colonise Mars? “It is not as crazy as it sounds,” wrote Viktor Shvets and Chetan Seth from the Macquarie global equities team. “A giant Mars colonisation program would create a vast, capital-intensive industry which would span the globe, create jobs, and address the global economy’s productivity problem.”

You see, the world economy is not growing at a sufficient rate because there are “declining returns on investment”. So what we need to do is to start a huge government programme to colonise Mars, similar to the space program of the 1960s under Kennedy that led to landing on the Moon.

Interestingly, the Macquarie economists are not interested in a global investment programme to help the poorest in the world to develop; to help solve the global environmental disaster or to boost education, health and basic infrastructure in the poorest countries on Earth. No, that is not as useful (profitable) as investing in another planet to get returns on investment up.

The Macquarie solution is the ultimate in Keynesian economic policy (short of ‘war Keynesianism’). It is the idea that there is plenty of capital available but just no ‘investment opportunities’ due to lack of demand. So war or space can offer a way out.

The Macquarie economists think that the huge injection of money and credit into financial assets, that has driven interest rates to zero or below is what has created low returns. But low returns on capital, generated by too much capital, is a neoclassical marginalist theory (that Keynes held to). It is confusing ‘fictitious’ capital with productive capital.

The Marxist view is different. Productive investment is not taking place because of ‘too much capital and low demand’ but because of too little surplus value or profitability from productive capital. And low profitability will not be improved by government spending on a space program. On the contrary. In the 1960s, the space program was affordable because of high (not low) profitability in the capitalist sector. So unproductive expenditure, which no doubt did develop new technology and employment for many, was affordable. That is the opposite now. There is no way out through Mars.

Still stuck in the Jackson Hole

August 27, 2016

Every August, the central bankers of the world meet at Jackson Hole, Wyoming, amid the Grand Teton mountains in mid-west America, to discuss the state of the world economy and the role of monetary policy and central banks. The central bank chiefs hear papers presented by leading mainstream economists in a restful weekend symposium hosted by the Kansas City Fed. Usually, it is an opportunity for the head of the US Federal Reserve, the hegemonic central bank, to make a speech outlining what’s happening in the US economy and future monetary policy (and its efficacy).

This August it was the turn of Janet Yellen, the current Fed chief. Global investors and financial market participants always await expectantly to see what the Fed is thinking. The immediate issue for markets is whether the Federal Reserve will resume its plan to raise its ‘policy’ interest rate towards a ‘normal’ level. The Fed policy rate is the floor for all other rates, like bank loan rates for households and companies and also for international rates, given the predominant position of Wall Street in global finance.

The Fed under Janet Yellen hiked its policy rate back in December 2015 for the first time in nine years, supposedly as the start of the move back to ‘normal’ – on the grounds that the US economy was fast recovering back to trend economic growth and full employment. Yellen explained that the US economy “is on a path of sustainable improvement.” and “we are confident in the US economy”. But since December, the Fed has sat on its hands.

Why? Well, the return to trend growth has not materialised and inflation has not risen. In the first half of 2016, the US economy has expanded in real terms (after inflation) at less than 1%, more one-third the ‘normal’ rate. The economy has been slowing down, not accelerating.

At the same time, inflation fell back too.

So the Fed paused on its ‘normalisation’ policy. Indeed, there was talk of opting for cutting the policy rate and even introducing ‘negative’ interest rates. However, the Fed’s chiefs remained optimistic. Just before the Jackson Hole symposium, Fed vice-chair Stanley Fischer made a speech in which he reckoned that “the economy has returned to near-full employment in a relatively short time after the Great Recession, given the historical experience following a financial crisis.”

Now in Yellen’s Jackson Hole speech, she reiterated her confidence in the sustainability of the US economic ‘recovery’ and hinted that the Fed would soon resume its hiking of the policy rate. Yellen said: “In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.” Yellen added that the US economy was “now nearing the Federal Reserve’s statutory goals of maximum employment and price stability”.

Central bank ‘conventional’ measures before the global financial crash boiled down to manipulating the basic interest rate for borrowing or providing cash or credit for limited periods to tide banks over in a slump. But such was the depth and width of the impact of the global financial crash and Great Recession on the banks and the wider economy, central banks had gradually adopted more ‘unconventional’ measures, such as printing money to buy government and corporate bonds from banks at high prices to provide liquidity for the banks to lend on to ‘real economy’; and to offer ‘forward guidance’ to the markets and industry i.e. a commitment to keep interest rates as low as possible for as long as possible so that ‘confidence’ in investing was restored. The ECB’s version of this ‘forward guidance’’ was for ECB chief Mario Draghi to announce that the ECB would“do what it takes” to get the Eurozone economy moving.

However, as the world economy continued to crawl along, with GDP growth stuck, unemployment falling back very slowly and many economies slipping into outright deflation (bad news for those with big debts), it was clear that monetary policy, conventional or unconventional, had failed. In the last year, many have called for more radical measures and some central banks have adopted them; namely, ‘negative interest rates’ (Sweden, Switzerland, Japan) and even consideration of ‘helicopter money’ (straight cash handouts to households); or the abolition of paper money so that all money is kept in banks electronically to be spent (and not stuffed under mattresses). This last proposal is the ultimate in bank dictatorship over people’s rights to their cash savings.

Just before Yellen’s speech, San Francisco Fed chief, John Williams had suggested setting higher inflation or ‘nominal’ GDP growth targets (so that central banks print even more money). And it is interesting that all the papers presented to the Jackson Hole symposium by various mainstream academic economists had one basic theme: existing monetary policy is not working and we need to consider more unconventional and extreme measures.

The economic strategists of capital are worried that monetary policy is not working to get the world economy (and the US economy) out of its ‘secular stagnation’. The failure of current monetary policy pushes the monetarists like former Fed chief Ben Bernanke into proposing yet more of the same (cutting rates) and more of the not same (helicopter money).

Yellen was vaguely sympathetic to Williams’ idea, but on balance, argued that nothing else was needed. And anyway, relying too heavily on these non-traditional tools could have “unintended consequences” as it might encourage “excessive risk-taking” and undermine financial stability. She argued that the Fed would not need to adopt any new measures of ‘unconventional’ monetary policy beyond those adopted since the onset of the Great Recession in 2008. Indeed, these measures could actually make the economic and financial situation worse. “Monetary policy is not well equipped to address long-term issues like the slowdown in productivity growth,” said Fed vice chair Stanley Fischer.

The alternative policy answer of the Keynesians like Paul Krugman, Larry Summers and Yellen herself is to call for government infrastructure spending and other efforts to counter weak growth, sagging productivity improvements, and lagging business investment. You see the problem is that the capitalist sector is not investing sufficiently to get productivity of labour growing faster and thus real GDP growth.

As a share of GDP, US annual business investment since 2008 has averaged nearly a full percentage point below the previous decade’s average, government data shows. This has generated an investment shortfall equivalent to $1trn with what it would have been if the previous trend continued. Little suggests a rebound any time soon. Fixed business investment has fallen in three successive quarters as a share of GDP and for the last three quarters up to Q2 2016.

And it is not as if the evidence is not there that the US (and UK) economies need to invest in new infrastructure and technology to lower costs and improve efficiency. The American Society of Civil Engineers has all we need to know.

But would government investment compensate? In most major capitalist economies, business investment to GDP is about 13-15% while government investment is about 1-3%, or about seven times smaller. If business investment slips by 1-2% of GDP, then government investment would have to nearly double in GDP terms to just stand still. And that assumes that governments controlled by big business and big finance would contemplate a doubling of government investment that involves large increases in taxation or rising interest rates for borrowing (in other words, enchroaching on profitability) (Kalecki).

As I have argued in this blog, what matters in a capitalist economy is the profitability of capital and the mass of profits generated by the workers employed. If the profitability is capital is too low and the capitalist sector remains dominant, investment and economic growth will not recover whatever central banks do or government spending does.

Indeed, there is yet more evidence from the Federal Reserve own economists that this is right. In a recent study, two Fed economists asked chief financial officers of major corporations and found the corporate internal rate of return needed to justify capital projects has “hovered near 15% for decades,” and barely budged even as global interest rates have fallen. So even if interest rates stay near zero or go negative or if helicopter money is handed out, it won’t make any difference if companies don’t think they can get their 15%.Fed on investment.

It is no accident that Marxist studies of the US corporate rate of profit in the productive sectors (i.e. non-financial) since the 1980s confirm an average rate of about 15%. US companies now expect 15% but can’t get it. So they buy back their own shares or increase dividends instead on investing in new technology, plant or equipment.

So yet again, it is profitability of capital that matters and from there to investment and growth. Yellen and Fischer cite higher employment and consumption as reasons for hiking interest rates now. But these are ‘lagging’ indicators; their movement ultimately depends on what is happening with business investment and behind that, profitability.

And the latest figures on US corporate profits that came out just this week for the first half of 2016 make dismal news. US corporate profits fell 4.9% in Q2 2016, compared to this time last year. And after tax was deducted, profits were down 6.3% compared to last year.

Corporate profits are the main driver of business. Where profits go, business investment is soon to follow, like the usual ‘night follows day’ proverb. And there is yet new evidence that this is right. Emre Ergungor is a senior economic advisor in the Research Department of the Federal Reserve Bank of Cleveland. He has been working on a model that can predict economic recessions. Most existing models try to predict recessions based on the movement of short-term and long-term interest rates. But they are not very good. Currently such models are reckoning the likelihood of a recession at no more than 20%. ec 201609 recession probablilities

But the Ergungor came across a startling fact (already known to the readers of this blog) that there is a very high correlation between the movement of business profits, investment and industrial production! He found that “A simple correlation analysis shows that the correlation between the change in corporate profits and the contemporaneous change in industrial production is 54 percent, but the correlation goes up to 66 percent if I use the one-quarter-ahead change in industrial production. Similarly, the correlation between the change in corporate profits and the contemporaneous change in gross domestic private investment is 57 percent, but the correlation goes up to 68 percent if I use the one-quarter-ahead change in investment. More formally, a Granger causality test indicates that the quarterly change in profits leads the quarterly change in production by one quarter, but the change in profits is independent of the change in production. A similar relationship applies to the quarterly change in profits and investment.6 Thus, firms seem to adjust their production and investment after seeing a drop in their profits.”

This is very similar to the correlations and Granger causality tests that I found and others have too. The time gap between profits and investment is about three quarters of a year. So Cleveland developed a new recession model to include corporate profits and found that “In early 2016, model 3 assigned an 81 percent probability to a recession in the next 12 months, and model 4 assigned a 73 percent probability to the same event. Thus, the consideration of the decline in corporate profits in this period worsened the recession probability by 8 percentage points. As credit spreads declined later in the period, the recession probabilities from both models declined to around 30 percent.” Cleveland cautions that their model does not always predict a recession. But the model is way better than one based on interest rates only.

I have spelt all this out in detail because it adds yet more evidence to the Marxist economic case that it is profits that matter and investment that decides, not the price or quantity of money (monetarism) or consumption and employment (Keynesianism). So expect business investment to fall further over the next few quarters. If the Fed decides to hike interest rates in the middle of that, it could well trigger a new economic recession if stock markets fall and the fictitious financial value of companies is exposed to the reality of their profits.

This August it was the turn of Janet Yellen, the current Fed chief. Global investors and financial market participants always await expectantly to see what the Fed is thinking. The immediate issue for markets is whether the Federal Reserve will resume its plan to raise its ‘policy’ interest rate towards a ‘normal’ level. The Fed policy rate is the floor for all other rates, like bank loan rates for households and companies and also for international rates, given the predominant position of Wall Street in global finance.

The Fed under Janet Yellen hiked its policy rate back in December 2015 for the first time in nine years, supposedly as the start of the move back to ‘normal’ – on the grounds that the US economy was fast recovering back to trend economic growth and full employment. Yellen explained that the US economy “is on a path of sustainable improvement.” and “we are confident in the US economy”. But since December, the Fed has sat on its hands.

Why? Well, the return to trend growth has not materialised and inflation has not risen. In the first half of 2016, the US economy has expanded in real terms (after inflation) at less than 1%, more one-third the ‘normal’ rate. The economy has been slowing down, not accelerating.

At the same time, inflation fell back too.

So the Fed paused on its ‘normalisation’ policy. Indeed, there was talk of opting for cutting the policy rate and even introducing ‘negative’ interest rates. However, the Fed’s chiefs remained optimistic. Just before the Jackson Hole symposium, Fed vice-chair Stanley Fischer made a speech in which he reckoned that “the economy has returned to near-full employment in a relatively short time after the Great Recession, given the historical experience following a financial crisis.”

Now in Yellen’s Jackson Hole speech, she reiterated her confidence in the sustainability of the US economic ‘recovery’ and hinted that the Fed would soon resume its hiking of the policy rate. Yellen said: “In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.” Yellen added that the US economy was “now nearing the Federal Reserve’s statutory goals of maximum employment and price stability”.

Central bank ‘conventional’ measures before the global financial crash boiled down to manipulating the basic interest rate for borrowing or providing cash or credit for limited periods to tide banks over in a slump. But such was the depth and width of the impact of the global financial crash and Great Recession on the banks and the wider economy, central banks had gradually adopted more ‘unconventional’ measures, such as printing money to buy government and corporate bonds from banks at high prices to provide liquidity for the banks to lend on to ‘real economy’; and to offer ‘forward guidance’ to the markets and industry i.e. a commitment to keep interest rates as low as possible for as long as possible so that ‘confidence’ in investing was restored. The ECB’s version of this ‘forward guidance’’ was for ECB chief Mario Draghi to announce that the ECB would“do what it takes” to get the Eurozone economy moving.

However, as the world economy continued to crawl along, with GDP growth stuck, unemployment falling back very slowly and many economies slipping into outright deflation (bad news for those with big debts), it was clear that monetary policy, conventional or unconventional, had failed. In the last year, many have called for more radical measures and some central banks have adopted them; namely, ‘negative interest rates’ (Sweden, Switzerland, Japan) and even consideration of ‘helicopter money’ (straight cash handouts to households); or the abolition of paper money so that all money is kept in banks electronically to be spent (and not stuffed under mattresses). This last proposal is the ultimate in bank dictatorship over people’s rights to their cash savings.

Just before Yellen’s speech, San Francisco Fed chief, John Williams had suggested setting higher inflation or ‘nominal’ GDP growth targets (so that central banks print even more money). And it is interesting that all the papers presented to the Jackson Hole symposium by various mainstream academic economists had one basic theme: existing monetary policy is not working and we need to consider more unconventional and extreme measures.

The economic strategists of capital are worried that monetary policy is not working to get the world economy (and the US economy) out of its ‘secular stagnation’. The failure of current monetary policy pushes the monetarists like former Fed chief Ben Bernanke into proposing yet more of the same (cutting rates) and more of the not same (helicopter money).

Yellen was vaguely sympathetic to Williams’ idea, but on balance, argued that nothing else was needed. And anyway, relying too heavily on these non-traditional tools could have “unintended consequences” as it might encourage “excessive risk-taking” and undermine financial stability. She argued that the Fed would not need to adopt any new measures of ‘unconventional’ monetary policy beyond those adopted since the onset of the Great Recession in 2008. Indeed, these measures could actually make the economic and financial situation worse. “Monetary policy is not well equipped to address long-term issues like the slowdown in productivity growth,” said Fed vice chair Stanley Fischer.

The alternative policy answer of the Keynesians like Paul Krugman, Larry Summers and Yellen herself is to call for government infrastructure spending and other efforts to counter weak growth, sagging productivity improvements, and lagging business investment. You see the problem is that the capitalist sector is not investing sufficiently to get productivity of labour growing faster and thus real GDP growth.

As a share of GDP, US annual business investment since 2008 has averaged nearly a full percentage point below the previous decade’s average, government data shows. This has generated an investment shortfall equivalent to $1trn with what it would have been if the previous trend continued. Little suggests a rebound any time soon. Fixed business investment has fallen in three successive quarters as a share of GDP and for the last three quarters up to Q2 2016.

And it is not as if the evidence is not there that the US (and UK) economies need to invest in new infrastructure and technology to lower costs and improve efficiency. The American Society of Civil Engineers has all we need to know.

But would government investment compensate? In most major capitalist economies, business investment to GDP is about 13-15% while government investment is about 1-3%, or about seven times smaller. If business investment slips by 1-2% of GDP, then government investment would have to nearly double in GDP terms to just stand still. And that assumes that governments controlled by big business and big finance would contemplate a doubling of government investment that involves large increases in taxation or rising interest rates for borrowing (in other words, enchroaching on profitability) (Kalecki).

As I have argued in this blog, what matters in a capitalist economy is the profitability of capital and the mass of profits generated by the workers employed. If the profitability is capital is too low and the capitalist sector remains dominant, investment and economic growth will not recover whatever central banks do or government spending does.

Indeed, there is yet more evidence from the Federal Reserve own economists that this is right. In a recent study, two Fed economists asked chief financial officers of major corporations and found the corporate internal rate of return needed to justify capital projects has “hovered near 15% for decades,” and barely budged even as global interest rates have fallen. So even if interest rates stay near zero or go negative or if helicopter money is handed out, it won’t make any difference if companies don’t think they can get their 15%.Fed on investment.

It is no accident that Marxist studies of the US corporate rate of profit in the productive sectors (i.e. non-financial) since the 1980s confirm an average rate of about 15%. US companies now expect 15% but can’t get it. So they buy back their own shares or increase dividends instead on investing in new technology, plant or equipment.

So yet again, it is profitability of capital that matters and from there to investment and growth. Yellen and Fischer cite higher employment and consumption as reasons for hiking interest rates now. But these are ‘lagging’ indicators; their movement ultimately depends on what is happening with business investment and behind that, profitability.

And the latest figures on US corporate profits that came out just this week for the first half of 2016 make dismal news. US corporate profits fell 4.9% in Q2 2016, compared to this time last year. And after tax was deducted, profits were down 6.3% compared to last year.

Corporate profits are the main driver of business. Where profits go, business investment is soon to follow, like the usual ‘night follows day’ proverb. And there is yet new evidence that this is right. Emre Ergungor is a senior economic advisor in the Research Department of the Federal Reserve Bank of Cleveland. He has been working on a model that can predict economic recessions. Most existing models try to predict recessions based on the movement of short-term and long-term interest rates. But they are not very good. Currently such models are reckoning the likelihood of a recession at no more than 20%. ec 201609 recession probablilities

But the Ergungor came across a startling fact (already known to the readers of this blog) that there is a very high correlation between the movement of business profits, investment and industrial production! He found that “A simple correlation analysis shows that the correlation between the change in corporate profits and the contemporaneous change in industrial production is 54 percent, but the correlation goes up to 66 percent if I use the one-quarter-ahead change in industrial production. Similarly, the correlation between the change in corporate profits and the contemporaneous change in gross domestic private investment is 57 percent, but the correlation goes up to 68 percent if I use the one-quarter-ahead change in investment. More formally, a Granger causality test indicates that the quarterly change in profits leads the quarterly change in production by one quarter, but the change in profits is independent of the change in production. A similar relationship applies to the quarterly change in profits and investment.6 Thus, firms seem to adjust their production and investment after seeing a drop in their profits.”

This is very similar to the correlations and Granger causality tests that I found and others have too. The time gap between profits and investment is about three quarters of a year. So Cleveland developed a new recession model to include corporate profits and found that “In early 2016, model 3 assigned an 81 percent probability to a recession in the next 12 months, and model 4 assigned a 73 percent probability to the same event. Thus, the consideration of the decline in corporate profits in this period worsened the recession probability by 8 percentage points. As credit spreads declined later in the period, the recession probabilities from both models declined to around 30 percent.” Cleveland cautions that their model does not always predict a recession. But the model is way better than one based on interest rates only.

I have spelt all this out in detail because it adds yet more evidence to the Marxist economic case that it is profits that matter and investment that decides, not the price or quantity of money (monetarism) or consumption and employment (Keynesianism). So expect business investment to fall further over the next few quarters. If the Fed decides to hike interest rates in the middle of that, it could well trigger a new economic recession if stock markets fall and the fictitious financial value of companies is exposed to the reality of their profits.

No hay comentarios:

Publicar un comentario